The money is back on Wall Street, and so is the status anxiety

Monday, May 16, 2011 at 04:54PM

Monday, May 16, 2011 at 04:54PM

Substance or style were clearly irrelevant this week. Size and name recognition were enough. -- "In Contemporary Art Sales, Big is Better and Famous is Best". The New York Times, May 13 2011.

Can there be any clearer sign that it is business as usual on Wall Street than the return of preposterous prices for idiotic art? At the end of 2008, as the depths of the credit crisis were starting to become apparent, Sotheby’s of London auctioned off 223 works by the former bad boy of British art, Damien Hirst. When the gavel finally fell on the last lot, Hirst was $200 million to the good, a record haul for an auction devoted to a single artist.

At the time, it seemed like the last great flareup of a bull-market in art that that was fueled by the same real-estate bubble that was juicing bonuses on Wall Street. Over the past decade, the Mei Moses All Art index (a sort of TSX for art investments) had outperformed bonds and bills, and in the first half of 2008 it gained a solid 7.4 per cent even as the S&P 500 was enduring double-digit declines. But given that the art market typically lags about six months to a year behind the stock market, it would only be a matter of time before art saw the same sort of declines as equities.

Sorry, where were we? Right, last week in New York:

Estimates had been set at a super maximum. The first three top prices were paid by bidders battling against the reserve. Rarely was the speculative character of the market more blatant.

And later:

Bidders scrambled to buy everything and anything. A set of three cibachrome prints mounted on board and executed by Janine Antonini in 1994 opened the proceedings. The banality of the photographic images from an edition of 10 that were offered under the title “Mom and Dad” did not seem promising. Yet the set sold for $182,500.

Back when people were still paying a king's ransom for second-rate Hirsts, Robert Hughes wrote a wonderfully sour article for the Guardian calling Hirst a "pirate" and blamed him for almost single-handedly creating the cult of artist-as-celebrity, and feeding the “irrational faith in a continuous rise in prices.”

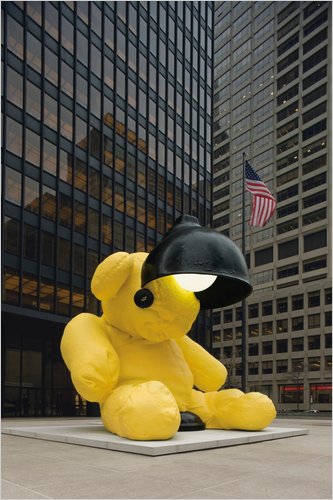

We can see now that Hirst himself had almost nothing to do with it. As usual in these sorts of cases, the key is not remember to blame the buyer, not the seller. Blame the john, not the prostitute. In his 2008 book about contemporary art, The $12 Million Stuffed Shark, York University business professor Don Thompson observes that “there is almost nothing you can buy for $12 million that will generate as much status and recognition as a branded work of contemporary art.” As he says, some people think a Lamborghini is vulgar, and lots of people can afford yachts. But put a Damien Hirst dot painting on your wall, and the reaction is, “Wow, isn’t that a Hirst?”

The point is, Hirst was not selling art, he was selling a cure for rich people with more money than taste. But while everyone may have moved on from rotting sheep in formaldehyde, the money is back, and so, quite obviously, is the status anxiety.

contemporary art,

contemporary art,  hirst,

hirst,  koons,

koons,  melkian,

melkian,  wall street,

wall street,  warhol

warhol